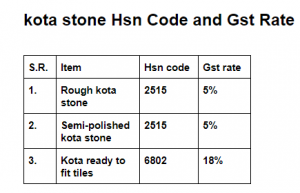

kota stone hsn code and gst rate in kota Rajasthan hsn code and gst rate is different between Rough kota stone and finished kota stone ( kota stone ready made tiles) the Indian Government’s ambitious “One nation one Tax” System, GST (Goods and Service tax) is imposed on every type of Business. There are various GST rates of Building construction material like kota stone (building material). GST rates of kota stone stone is imposed using the HSN Code. “Harmonized System of Nomenclature” or simply HSN is a multipurpose product nomenclature designed by “world customs organization”. Our Government used kota stone hsncode and gst rate in GST invoicing to meet the tuning of Indian standard with international Standard.

kota stone hsn code and gst rate

Under GST, Tax rates vary between 0%, 5%, 12%, 18% and 28%. The Government of India announced flat 5% GST rate on unfinished kota stone. 18% gst rate of finished kota stone ( kota stone ready made tiles) Building Stone Material like Rough kota stone or semi-polshed kota stone and kota stone ready made tiles

Item name Hsn code Rate

- kota stone rough/semi-polished 25152090 5%

- Kota stone ready made tiles 6802 18%